2025: Year in Review

2025 Year in Review: Strong Results, Changing Conditions

The transition from one year to the next is always a moment to reflect on what has passed and to set expectations for what lies ahead.

After reaching a company record in 2024 — representing almost a 50% increase compared to both 2023 and 2022 — Casteels & Eriksson managed to broadly maintain that level throughout 2025. While this in itself is a solid result, our internal objective for the year was to build further on that momentum, with a targeted increase of approximately 25% in sales. That target was not achieved.

The year followed an unusual trajectory. During the first half of 2025, we were performing exceptionally strongly and were on track not only to surpass our 2024 record, but also to exceed our projected targets. In fact, more than 70% of our total annual sales were completed in the first six months of the year. As a result, the second half of 2025 felt comparatively subdued, prompting a thorough internal analysis of both our own performance and broader market conditions.

Our conclusion is that transactions in 2025 were materially harder to bring to completion than in previous years. The strong first half was largely driven by an excellent pipeline of listings and buyers generated during 2024, while the second half exposed a slowdown in new deal flow and longer decision cycles. This points to a mild market correction following several very active years in the local market, rather than a structural weakness in demand, as well as a shift towards a buyer’s market where vendors need to price correctly in order to sell.

One specific segment that was clearly affected this year was rental-investment-driven apartment purchases. Changes to the legal framework for holiday rentals introduced in April 2025 created uncertainty among investors. With both town halls and residential communities now able to influence the granting of rental licences, many buyers chose to delay decisions until greater clarity emerges. This uncertainty had a noticeable impact on transaction volume in the second half of the year and appears to have been a broader market trend rather than something unique to our business.

We expect this situation to gradually stabilise as more residential communities address short-term rentals through their upcoming AGMs, providing clearer rules and reducing uncertainty for buyers. In anticipation of this, we have already adjusted our internal processes by placing greater emphasis on early due diligence around community statutes, existing licences and AGM history when advising investor clients. Extra attention from rental-investment buyers towards aparthotel property purchases may also further solidify, as we pointed out in this article.

Beyond short-term rentals, several upcoming regulatory developments are worth noting. One is the planned introduction of a real estate agency registry. If implemented correctly, this could represent an important step towards further professionalising the sector. We already highlighted the need for such a framework in our 2024 report, and it is encouraging to see this moving closer to reality.

Another significant update concerns the reduced transfer tax available to professional buyers. While the 2% rate remains in place, the updated rules introduce a maximum purchase price of €500,000 and reduce the resale window from five years to two. The stated logic behind these changes raised eyebrows. While a shorter resale window could arguably discourage long-term speculation, the two-year limit may prove unrealistic for many professional projects, particularly where renovation licences and municipal approvals are required. The price cap also appears counter-intuitive if the aim is to protect affordable housing. In practice, this change risks creating hesitation and reducing activity within the flip-investment market without delivering meaningful benefits to end users seeking affordable housing.

Looking ahead, market fundamentals on the Costa del Sol remain broadly supportive. Demand continues to be underpinned by international buyers, lifestyle relocations and limited housing supply. However, 2025 has been a clear reminder that strong results depend not only on market conditions, but on continually renewing pipelines, adapting to regulatory change and maintaining disciplined execution.

In 2026, our focus will be on rebuilding forward pipeline strength and nourishing our partnerships, while further refining our advisory role for both lifestyle buyers and investors, and maintaining a cautious, well-informed approach in an environment where regulation and decision-making timelines are increasingly influential.

“The second half of 2025 exposed longer decision cycles and a clear shift towards a more price-sensitive, buyer-led market.”

Tim Casteels - Founder & Sales Director

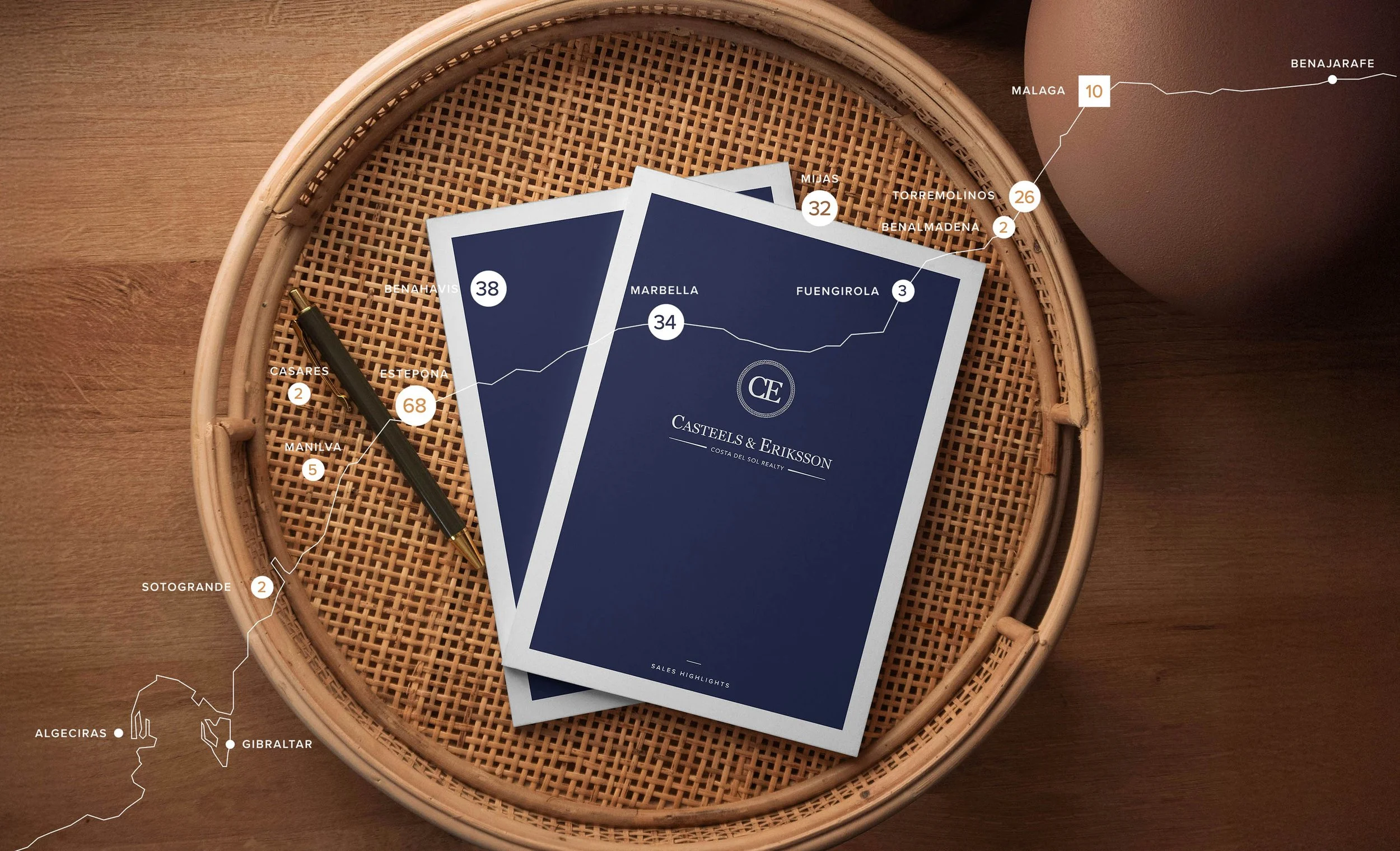

47

Total Sales

€39.955.000

Total Sales Volume

€10.325.000

Highest Sale

€850.106

Average Sale Price

41

New Listings

15

Buyer Nationalities

A Decade of Sales, Built on Trust

For over ten years, we’ve guided clients through one of life’s biggest decisions with honesty, care, and local knowledge. This booklet highlights meaningful sales — not just for the homes, but for the trust behind them. Many clients return, and many refer others. That says more than we ever could.

Rental Law Changes on the Costa del Sol: What Property Buyers Need to Know

Insights

Guaranteed Returns & Effortless Ownership that Grows in Value

Insights

Stay Up to Date

Be the first to explore extraordinary properties with stunning visuals, detailed descriptions, and insider information. Stay ahead in the real estate market and find your dream property with an advantage.